Strategical Advisory

At West Point Financing, Inc, we understand that navigating the financial world can be daunting. But we assure you, you're not alone. We provide strategic consulting services that are robust and tailored to your unique needs. Our approach to financial consulting starts and ends with comprehensive planning. We shoulder the burden of analysis and evaluation to provide clear insights into your situation and potential solutions. Our team designs your transactions independently of underwriting, ensuring you fully comprehend your optimal advantage and course of action.

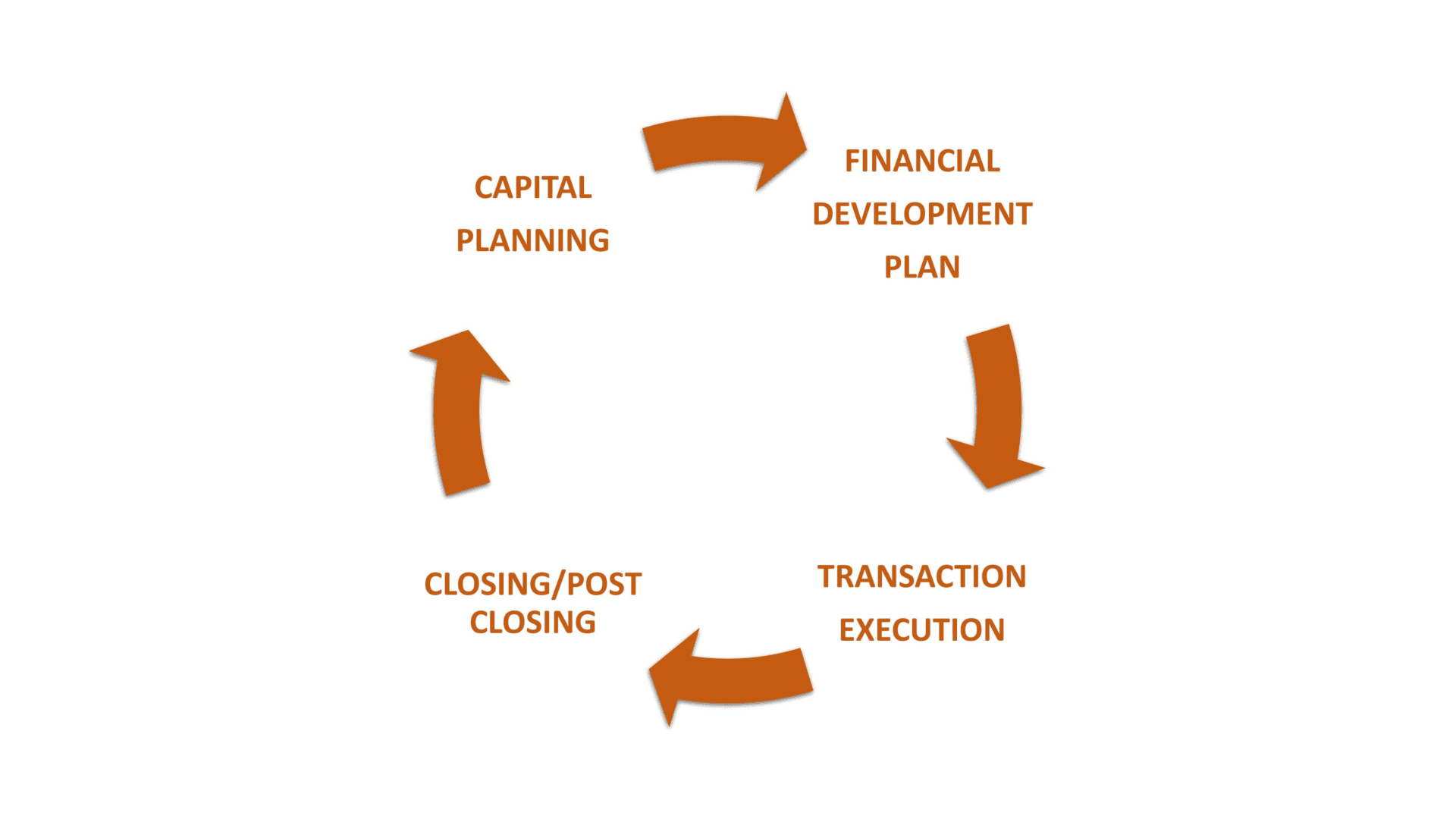

Our Process

Our process is divided into four key phases.

Phase 1 - Capital Planning

At this stage, we collaborate with you to create the right tools, pro forma, and models to analyze and evaluate your operational and capital requirements.

Phase 2 - Finance Development Plan

Here, we develop multi-year, short-term, and long-term projects or groups of projects, determining precise levels of debt, alternative capital resources, and funding sources.

Phase 3 - Transaction Execution

At this stage, we handle document development, due diligence, and logistics to complete the transaction, giving you the advantage, no matter the financing method.

Phase 4 - Post-Closing

We coordinate the transaction closure, addressing both long and short-term post-closing matters. This process may extend beyond the closure and evolve into long-term planning, reverting back to Phase 1.

Our services in bonds, leasing, and financial consulting aim to provide strategic, hassle-free solutions for your financial needs.